Across the ditch findings from ASIC’s financial reporting surveillance

Across the ditch findings from ASIC’s financial reporting surveillance

The Australian Securities and Investments Commission (ASIC) published its findings from its financial reporting surveillance program, covering the period 1 July 2023 to 30 June 2024.

Although New Zealand’s Financial Markets Authority (FMA) has not released a similar report for New Zealand entities that fall under the FMA’s surveillance programme, preparers of financial statements should be aware that regulators world-wide (including both the FMA and ASIC) tend to focus on similar areas in their reviews. As a result, the results from the ASIC report are equally valid to New Zealand reporting entities.

The findings, contained in the latest ASIC report - Report 799 ASIC’s oversight of financial reporting and audit 2023-24 (Report 799), largely highlight similar ‘problem areas’ we saw in last year’s report.

Approach and statistics

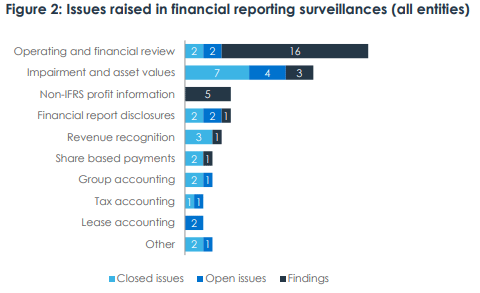

ASIC uses a risk-based approach to target financial reports for review. ASIC may then decide to also review the audit file where it is concerned that a financial report may have a risk of material misstatement. In this cycle ASIC reviewed 188 financial reports, which has so far resulted in findings against 25 entities and adjustments worth $1.88 billion. ASIC contacted 39 entities regarding 61 issues, which are shown in Figure 2 below (extracted from Report 799):

Key outcomes

Three entities made a total of $1.88 billion in adjustments to prior periods because of ASIC’s findings. The outcomes were detailed in ASIC financial reporting media releases throughout the year and were in relation to:- Impairment, expenses and provisions

- Revenue recognition – agent versus principal

- Failure to consolidate a subsidiary.

- Inadequate risk disclosures in the Operating and Financial Review (OFR), including sustainability-related risk (two entities)

- Inadequate disclosure about unbilled disbursements and disbursements funding interest

- Failing to include comparatives in general purpose financial statements lodged with ASIC after the lodgement exemption for large grandfathered private companies was scrapped

- Using key assumptions in impairment models that were not reasonable and supportable.

Additionally, sixteen entities have made or agreed to make changes to their OFR disclosures, particularly regarding risk and non-IFRS profit information.

Observations

Report 799 fleshes out ASIC’s findings and recommendations from the ten broad categories shown in Figure 2 above.

Operating and financial review (OFR)

Section 299A of the Corporations Act 2001 requires listed entities to include an OFR as part of their directors’ report. It should provide information that shareholders would reasonably require to make an informed assessment of the entity’s operations, financial position, strategies and prospects for future financial years.ASIC found that many entities still need to improve their OFR reporting. The main deficiency was the lack of balance from not disclosing material business risks. Some entities also dispersed information throughout the financial report or other public announcements, rather than having a ‘one-stop shop’ for all this information in the OFR.

ASIC contacted 20 entities and 16 of them made additional or improved OFR disclosures.

| What you should do – Australian listed entities It is important to provide balance in reporting by discussing material business risks that may affect the achievement of expected prospects. The OFR should be tailored to the entity’s circumstances and not be too generic. Directors have a duty to monitor and report risks so it is important to have a well-developed and structured report which discusses business risks and how they might affect the business achieving its plans. Such a process will also help the entity implement sustainability reporting standards (applicable for years ending on or after 31 December 2025 for Group 1 entities). New Zealand listed entities: In New Zealand, although there is no direct equivalent requirement to Section 299A and New Zealand sustainability reporting requirements differ, listed entities should still ensure that their Directors’ – and/or Chairperson’s Reports provide relevant information about the entity’s operations, financial position, strategies and prospects for future financial years, and that all disclosures required by the Financial Markets Conduct Act 2013 (including climate-related disclosures for certain Financial Markets Conduct reporting entities with higher level of public accountability) are adequately complied with. |

Impairment and asset values

ASIC contacted 10 entities about 14 valuation and classification issues. Three entities adjusted their financial reports by:- Reclassifying an asset from current to non-current assets

- Reclassifying cash held in term deposits with more than three-month maturities from current to non-current assets (refer to our previous article for more information)

- Impairing assets.

What you should doMake sure you appropriately classify assets between current and non-current in the statement of financial position. You also need to ensure that assumptions used in asset valuations and impairment models are reasonable and supportable, and make impairment write-downs on a timely and appropriate basis. |

Non-IFRS profit information

ASIC contacted five entities, and all of them made changes to their financial reports. Three entities improved their non-IFRS profit disclosures, one added a reconciliation of the non-IFRS profit measure to statutory amounts, and one removed a non-IFRS profit measure completely.

What you should doRefer to the FMA’s guidance on Disclosing non-GAAP financial information to help reduce the risk of non-IFRS financial information being misleading. |

Financial report disclosures

Issues identified here related to the omission of prior year comparatives (the entity subsequently relodged its financial report with the required comparative information), and poor disclosures about going concern, operating segments, and laws and regulations.

Revenue recognition

ASIC contacted four entities about their revenue recognition policies, and one adjusted its policy to recognise indirect software revenue as an agent rather than as a principal.

Share-based payments

ASIC contacted three entities about their accounting and/or disclosures for share-based payments. One will amend its next financial report to reclassify vesting expenses from options to restricted shares.

Group accounting, tax accounting and lease accounting

Matters raised by ASIC related to:

- Group accounting – consolidation issues, not lodging consolidated accounts, and accounting for movements in subsidiary values

- Tax accounting – large variations between the tax expense and tax payments, and querying items on the tax reconciliation

- Lease accounting – franchise operations, and the application of AASB Interpretation 12 Service Concession Arrangements.

Sustainability reporting

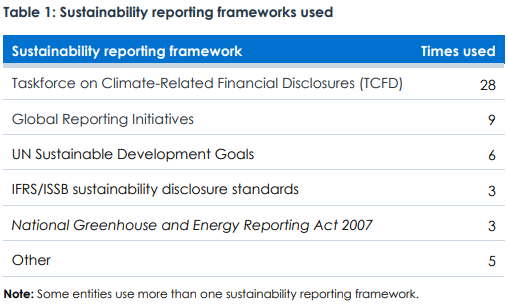

During the 2023-2024 review period, ASIC also monitored voluntary reporting by listed entities on sustainability and climate change. It reviewed annual and sustainability reports, investor presentations and market announcements. The findings will inform ASIC’s ongoing work to support the introduction and administration of the mandatory climate-related financial reporting regime.Of the 157 financial reports reviewed, only 56 contained disclosures on risks arising from climate change. A variety of frameworks were used as shown below:

Some interesting findings:

- Only 41 entities included governance and sustainability performance indicators for assessing remuneration

- Only six entities had their sustainability and governance disclosures voluntarily reviewed by their auditor.

Regulator expectations

The Report notes ASIC’s expectations regarding its financial reporting surveillance findings. All stakeholders in the financial reporting chain should carefully consider them, as well as ASIC’s focus areas for 30 June 2024.As mentioned above, we recommend that New Zealand entities falling under the FMA’s jurisdiction, also take note of the results from this ASIC report, as it is likely that the FMA will be focussing on similar areas as part of their surveillance programme.

Audit committees, directors and preparers of financial reports have a critical role in supporting high-quality financial reporting and the building blocks they need to support this include:

- High quality and timely financial information – robust position papers for difficult or contentious matters, accompanied by technical analysis and conclusions referencing accounting standards

- Adequate resources, skills and expertise applied in the financial reporting process – position papers should support conclusions reached, particularly in areas that involve significant estimation uncertainty and judgement (e.g. for asset values, revenue recognition and provisions).

For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here.