Entities may have to reclassify their borrowings at 31 December 2024 – Part 3

Entities may have to reclassify their borrowings at 31 December 2024 – Part 3

| BDO’s recent publication, IFRS Accounting Standards in Practice - Classification of loans as current or non-current, includes a flow chart and numerous examples to help you determine the correct classification of your loan arrangements. Our previous articles showcased examples where compliance with loan covenants is required at the end of or after the reporting period and before the end of the reporting period, and we also discussed how this impacts the classification of the loan arrangement. This article looks at examples where compliance with a loan covenant is required every quarter. |

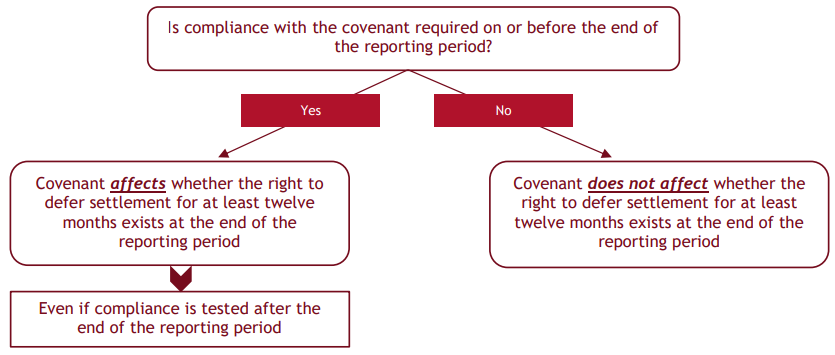

The following diagram summarises whether loan covenants will affect the classification of your loan arrangements (IAS 1 Presentation of Financial Statements, paragraph 72B):

To classify a loan as a non-current liability at the reporting date, it must meet any loan covenant test required on or before the end of the reporting period.

If the entity breaches a loan covenant before the reporting date such that the loan becomes repayable on demand, the loan would be classified as a current liability because the borrower does not have a right to defer settlement. However, if the entity obtains, before the end of the reporting period, a waiver for the breach, or a period of grace whereby the borrower agrees not to demand repayment for at least twelve months after the end of the reporting period, the loan is classified as a non-current liability.

Difference between a waiver and a period of grace

Our previous article explains the difference between a waiver and a period of grace in more detail. Neither term is defined in IAS 1, but to put it simply:|

Period of grace |

Waiver |

|

Lender agrees not to demand immediate repayment of the loan due to the breach for a specified period |

Lender surrenders its rights related to the breach of covenant |

|

At the end of the ‘period of grace’, the lender regains the right to demand immediate repayment resulting from the breach |

Permanent waiver – not for a specified period |

|

Suspension of rights |

Complete surrender of rights |

Assessing whether there has been a waiver may require a legal interpretation to understand the nature of the rights surrendered or retained by the lender.

Breaches of quarterly loan covenants

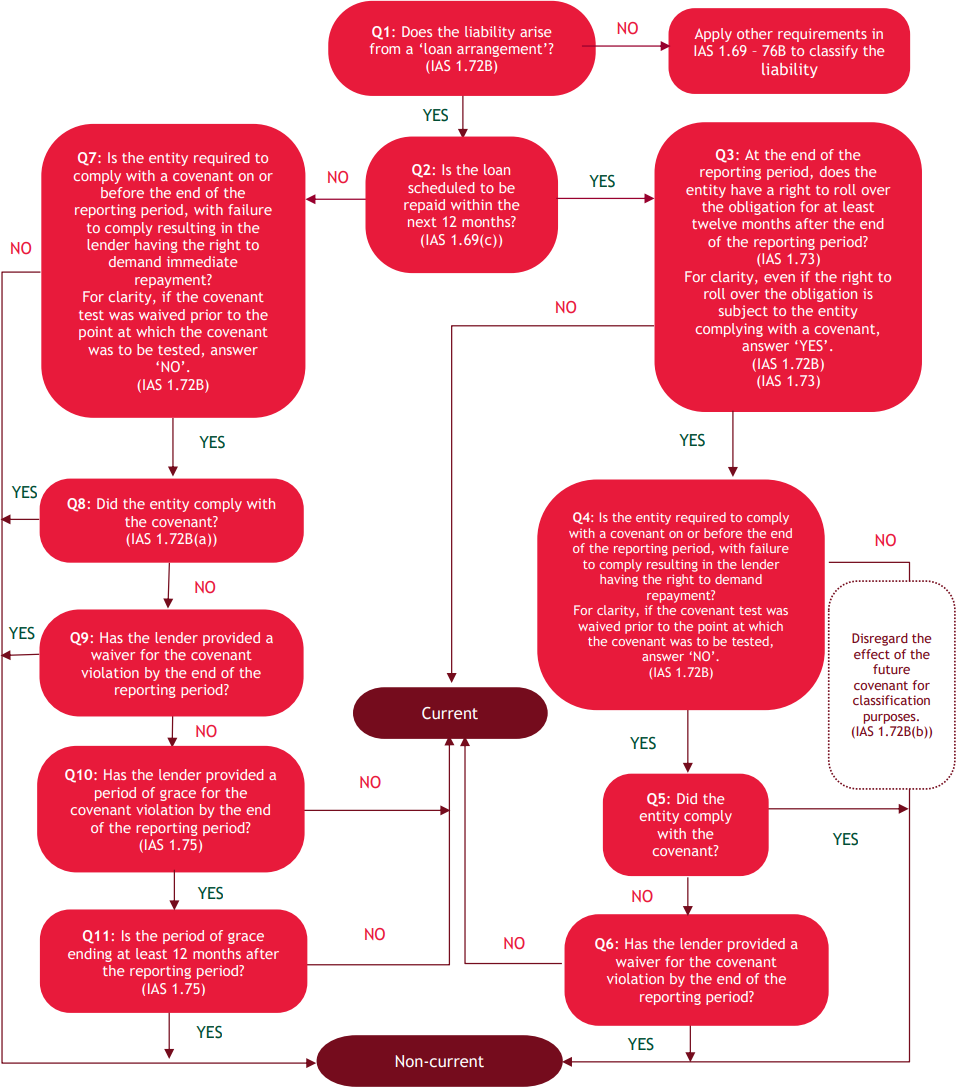

Our publication includes a flowchart to help you determine the appropriate classification of a loan arrangement when a covenant is required to be tested each quarter.

Examples

Our publication illustrates three examples where Entity A must comply with a quarterly loan covenant (examples C1 to C3) and identifies how this impacts the loan classification at the reporting date. For each example, the publication uses the above flow chart and walks you through step-by-step to arrive at the correct loan classification. For all these examples, the answer to Question 1 (Does the liability arise from a loan arrangement?) is ‘Yes’, and Question 2 (is the loan scheduled to be repaid within the next 12 months?) is ‘No’. Therefore, Questions 7 to 11 need to be considered.Base fact pattern

Entity A obtains a loan from Bank B on 1 January 20X0. The loan is repayable in full after five years.Entity A prepares quarterly interim financial statements, and its annual reporting period ends on 31 December.

The loan arrangement requires Entity A to have a working capital ratio of at least 1.5 as of 31 March, 30 June, 30 September and 31 December each year. If the covenant test for the working capital ratio is not met, Bank B has the right to demand immediate repayment of the loan up to the date of the next covenant test.

Examples C1 to C3

Example C1 to C3 relate to covenant testing for the purposes of classifying Entity A’s loan in the 31 March 20X1 interim financial statements.|

|

Example C1 (assumes quarterly testing on 31 March, 30 June, 30 September and 31 December each year) |

Example C2 (assumes quarterly testing on 28/29 February, 31 May, 31 August and 30 November each year) |

Example C3 (assumes quarterly testing on 31 March, 30 June, 30 September and 31 December each year) |

|

|

Current ratio is expected to be 1.4 as at 31 March 20X1. Anticipated breach is waived on 15 March 20X1. Current ratio is expected to be 1.45 as at 30 June 20X1. |

Current ratio is 1.45 as at 28 February 20X1. Breach is waived on 15 March 20X1. Current ratio is expected to be 1.6 as at 31 May 20X1. |

Current ratio is 1.4 as at 31 March 20X1 – no waiver or period of grace has been provided for this breach. Current ratio is 1.6 as at 30 June 20X1. |

|

Question 7: Is the entity required to comply with a covenant on or before the end of the reporting period, with failure to comply resulting in the lender having the right to demand immediate repayment? |

No |

Yes |

Yes |

| Note: If the covenant test was waived prior to the point at which the covenant was to be tested, answer ‘NO’. | The covenant test was waived prior to the covenant being tested. | The covenant test was not waived prior to the covenant being tested. | The covenant test was not waived prior to the covenant being tested. |

|

Question 8: Did the entity comply with the covenant? |

N/A |

No |

No – as at 31 March 20X1 Yes – as at 30 June 20X1 |

|

Question 9: Has the lender provided a waiver for the covenant violation by the end of the reporting period? |

N/A |

Yes |

No |

|

Question 10: Has the lender provided a period of grace for the covenant violation by the end of the reporting period? |

N/A |

N/A |

No |

|

Classification |

Non-current liability |

Non-current liability |

Current liability as at 31 March 20X1 Non-current liability as at 30 June 20X1 |

From the above examples, we can see:

- It makes no difference whether a waiver is received from the lender prior to a breach or after a breach, so long as the waiver is in place by the end of the reporting period.

- When assessing loan classification at the reporting date, Entity A ignores the next quarterly covenant test (IAS 1, paragraph 72B(b)). However, in Example C1, where Entity A does not expect the post-reporting-date covenant test to be met, it must provide the additional disclosures to enable users to understand the risk that liabilities could become payable within twelve months after the reporting period (IAS 1, paragraph 76A).

- Loan classification can fluctuate between current and non-current from one interim period to another. In Example C3, the covenant test was not met on 31 March 20X1, and the liability is classified as current in the 31 March 20X1 quarterly financial statements. The covenant test was met on 30 June 20X1, and the loan is classified as a non-current liability in the 30 June 20X1 quarterly financial statements.

Disclosure about standards issued not yet effective

We remind for-profit entities preparing Tier 1 general purpose financial statements of the requirement to disclose and quantify the impact of amending standards that will take effect in a later period. Entities with loan arrangements subject to loan covenants will have to assess the implications of these IAS 1 changes on their borrowings and disclose the effect on the comparative and opening balance sheets for reporting periods starting before 1 January 2024.

|

Year-end |

First-time application |

Comparative restatement |

Opening balance sheet |

|

31 December |

31 December 2024 |

31 December 2023 |

1 January 2023 |

|

31 March |

31 March 2025 |

31 March 2024 |

1 April 2023 |

|

30 June |

30 June 2025 |

30 June 2024 |

1 July 2023 |

|

30 September |

30 September 2025 |

30 September 2024 |

1 October 2023 |

More information

For more information on this topic, please look at our new publication which provides further explanation and examples.Need help?

Classifying loan arrangements and other liabilities as current or non-current may be complex. Deciding whether the bank has provided a waiver or a period of grace for a covenant breach can also be tricky, and the hurdle for a waiver is high. Please contact our IFRS® Advisory team for help.For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here