IFRIC agenda decision - Principal versus agent: software resellers

IFRS Interpretations Committee (the Committee) agenda decisions are those issues that the Committee decided not to take onto its agenda. Although this is not authoritative guidance, in practice these decisions are regarded as being highly persuasive. All entities reporting under IFRS should be aware of these decisions as they could impact the way that particular transactions and balances are accounted for. If there is an overlap in accounting requirements between IFRS / NZ IFRS and PBE Standards, these decisions would also impact on PBE Reporters.

As an addendum to its April 2022 meeting, the Committee issued a final agenda decision about whether a reseller of software licences is acting as principal or agent for the purposes of recognising revenue under IFRS 15 Revenue from Contracts with Customers.

Fact pattern

The Committee was presented with the following fact pattern:

- Software Manufacturer has Reseller (distributor) selling its software licences to customers

-

The terms of the distribution agreement with Reseller are:

- Reseller has the right to sell software licences to customers

- Reseller must provide pre-sales advice, such as the type and number of licences required. There is no charge to customer for this pre-sales advice

- Reseller has discretion in setting sales prices

- Reseller negotiates selling prices with customers

- Reseller places orders with Software Manufacturer on behalf of customers

- Reseller invoices the customer and then pays Software Manufacturer

- Software Manufacturer provides the software licences directly to customers (via a software portal and key activation)

- If Reseller advises a customer to purchase an incorrect type or number of licences, Reseller bears inventory risk. That is, Reseller cannot return these licences to Software Manufacturer and cannot sell them to anyone else.

Question

The Committee was asked whether Reseller is acting as an agent or principal in this fact pattern.

Analysis

The Committee noted that IFRS 15, paragraphs B34-B38, provide guidance on principal versus agent considerations.

When another party is involved in providing goods or services to a customer, it needs to be determined whether the nature of the entity’s promise is to:

- Provide specified goods or services itself (as principal), or

- Arrange for goods or services to be provided by another party (i.e. entity is acting as agent).

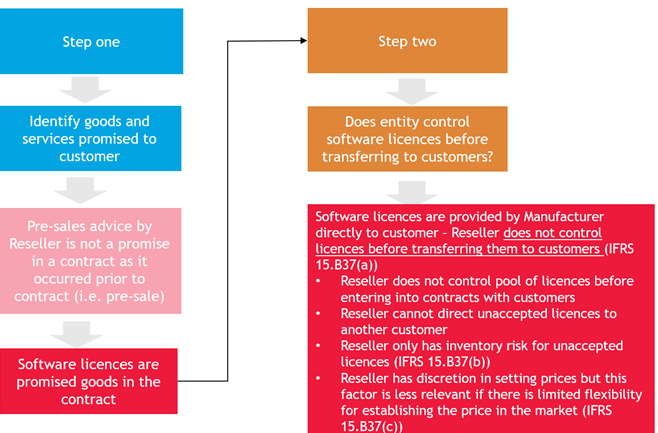

The diagram below considers the nature of the Reseller’s promise to customers.

Conclusion

The Committee noted that the conclusion as to whether the Reseller is acting as agent or principal depends on specific facts and circumstances. Judgement needs to be applied after considering the guidance contained in IFRS 15, paragraphs B34-B38.

The Committee also noted that Reseller would disclose:

- Its accounting policy as to whether it is acting as agent or principal (IAS 1.117)

- Information about its performance obligations (IFRS 15.119)

- Judgements regarding the principal versus agent assessment (IFRS 15.123).

The principles and requirements in the IFRS standards provide an adequate basis to deal with this fact pattern. Therefore, the Committee decided not to add a standard-setting project to its work plan.

More information

For more information, please refer to the agenda decision

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.