Meaningful reporting – 30 June 2022

While the immediate effects of COVID-19 may have subsided, entities continue to face changes in circumstances and uncertainties about future economic and market conditions, which may impact business strategies and future financial performance.

These uncertainties should be factored into the assumptions used for financial reporting purposes, and should be reasonable and supportable to ensure that financial statements provide useful and meaningful information for investors and other users.

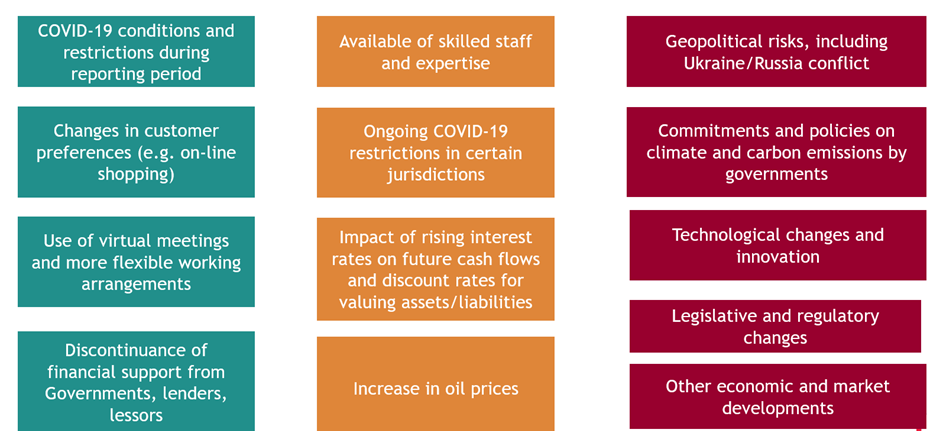

Examples of changes in circumstances, uncertainties, and risks to be considered when preparing 30 June 2022 financial reports include those listed in the diagram below. This list is not exhaustive.

The following sets out certain areas of the financial statements that directors and preparers should focus on for 30 June 2022 reporting

Asset values

|

Financial statement area |

Areas requiring focus |

|

Impairment of non-financial assets |

|

|

Values of property assets |

|

|

Expected credit losses (ECL) on loans and receivables |

|

|

Value of other assets |

|

Provisions

The adequacy of provisions for:

- onerous contracts,

- financial guarantees given,

- restructuring provisions,

- leased property make- good provisions, and

- mine site restoration provisions

should all be considered, taking current economic conditions into account.

Solvency and going concern assessments

Entities should consider factors affecting the business which could impact the entity’s solvency and going concern assessment. These were highlighted in the diagram above.

Subsequent events

Entities should review events occurring after the end of the reporting period, in order to determine whether these are ‘adjusting’ or ‘non-adjusting’ post-balance date events.

Disclosures in the financial statements and directors’ and/or chairperson’s reports

Lastly, entities should focus on ensuring adequate disclosures as outlined in the table below.

|

Consider |

Focus areas |

|

General considerations |

|

|

Disclosures in financial statements |

|

|

Disclosures in directors’ and/or chairperson’s reports |

|

|

Assistance and support by government and others (e.g. lenders and landlords) |

|

|

Non-IFRS financial information |

|

|

Disclosure in half-year financial statements |

|

Need assistance?

Please contact our IFRS Advisory team if you need support with any financial reporting matters for your 30 June 2022 financial reports.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.