Month-to-month leases are not always short-term leases

Month-to-month leases are not always short-term leases

IFRS 16 Leases does not require short-term leases to be capitalised on the statement of financial position, so there is a temptation to structure lease terms as being ‘month-to-month’ to apply this short-term lease exemption.

Types of month-to-month leases

Month-to-month leases do not specify an initial contract term. They continue indefinitely until either party to the contract gives notice to terminate and include the following:

- A ‘pop-up shop’ where the tenant only intends to occupy the premises for a short period, like over the Christmas holidays

- A retailer renting retail premises on a month-to-month basis because the landlord is unable to find a long-term tenant

- A subsidiary renting office premises from its parent on a month-to-month basis.

Undocumented arrangements for monthly rentals are also month-to-month leases if they convey the right for one entity (lessee) to use an asset (an identified asset) in exchange for consideration to another entity (lessor). This often occurs in a parent-subsidiary relationship where a subsidiary uses premises owned by its parent company, say a warehouse or a head office premises. The lack of a written contract does not necessarily mean that there is no lease contract.

What is a short-term lease?

A short-term lease is one that, at the commencement date, has a ‘lease term’ of twelve months or less. A lease that contains a purchase option is not a short-term lease.

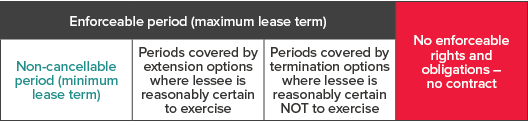

The ‘lease term’ is the non-cancellable period for which a lessee has the right to use an underlying asset, together with both of the following periods:

(a) Those covered by an option to extend the lease if the lessee is reasonably certain to exercise that option

(b) Those covered by an option to terminate the lease if the lessee is reasonably certain not to exercise that option.

Many preparers incorrectly assume that a month-to-month lease is always a short-term lease because the non-cancellable period is only one month.

However, the definition of ‘lease term’ in IFRS 16 also requires consideration of options that the lessee has to extend or terminate a lease. Lessor termination options are ignored when determining the lease term. That is, it is assumed that lessors will not exercise their termination options.

What is the lease term for a month-to-month lease?

The answer is ‘How long is a piece of string?’. It could be anywhere from one month to a very long period.

The diagram below illustrates that the enforceable period of a lease contract includes both types of options noted above, and the enforceable period is the maximum lease term.

IFRS 16, paragraph B34 notes that a lease is no longer enforceable when both of the following are true:

- The lessee and the lessor are able to terminate the lease at any time, without permission of the other party

- In terminating the lease, neither the lessee nor the lessor would incur a penalty that is more than insignificant if they terminate the lease contract. If one would incur a penalty, then the contract is still enforceable.

In its agenda decision (November 2019), the IFRS Interpretations Committee noted that in addition to contractual termination payments, the broader economics of the contract must be considered when assessing whether either party would incur ‘penalties’. Non-contractual penalties could include:

- Lessee has installed significant leasehold improvements with a useful life longer than one month

- Month-to-month lease rental is much lower than a market rental for a similar leased asset

- Location of asset is of strategic importance to lessee (e.g., property in high foot traffic location)

- Availability of alternative assets or premises for rental.

Example - Pop-up shops

PopUpStore, which has a 30 June year-end, enters into a month-to-month lease with the Shopping Centre on 1 October 2023 to sell its goods over Christmas. The monthly rental is $1,000, payable in arrears. The lease continues until either party exercises its right to terminate it with one month’s notice. PopUpStore intends to stay in the premises for about five months.

PopUpStore installed the following fit out in the shop, all of which is removable and can be used in subsequent years:

- Removable shelving

- Foldaway table

- Two plastic chairs

- Railing and curtain for fitting rooms.

It paid Two Men and a Van $100 to move its inventories into the store.

The enforceable period is likely to be for five months when PopUpStore intends to occupy the leased premises. At this point, it is reasonably certain to exercise its termination option. The lease term is, therefore, five months. PopUpStore can apply the short-term lease exemption in its 30 June 2024 financial statements.

For the year ended 30 June 2024, PopUpStore recognises the following journal entry for the short-term lease:

Dr Rental expense $5,000

Cr Bank $5,000

Applying paragraph B34, the lease is no longer enforceable after five months because:

- Both PopUpStore and Shopping Centre can terminate the lease at any time without permission of the other party

- In doing so, neither party would incur penalties that are more than insignificant.

Example – Retailer

Retailer, which has a 30 June year-end, enters into a month-to-month lease with Strip Mall on 1 October 2023 to sell its vintage clothing. Either party can terminate the lease with one month’s notice.

The monthly rental is $900, payable in arrears. Strip Mall would usually charge rental of $1,200 for this shop but has yet to find tenants willing to pay that amount because the centre is being refurbished. The arrangement suits both parties because Retailer incurs a rental expense lower than market rentals until Strip Mall can find a tenant willing to pay market rentals.

Retailer installed only basic moveable equipment in the shop, including railings and curtains for fitting rooms. Costs of moving inventories into and vacating the store are minimal.

Under paragraph B34, the lease is likely to be enforceable until Strip Malls finds another tenant. It will be enforceable prior to that occurring because there will be penalties for Retailer to terminate early as it is not likely to find a similar shop at a below-market rental.

As such, Retailer’s assessment must now consider its judgement as to what point in time it reasonably expects that Strip Mall will no longer have more than an insignificant penalty to not use the its termination option (i.e., that Strip Mall would be penalised in continuing on with the lease under the agreed $900 lease payment). This could be for example, when Strip Mall is expected to complete its refurbishment and can therefore attract a new tenant at a higher monthly rental.

If Strip Mall is expected to complete its refurbishment within twelve months from commencement of the lease, the lease could be considered a short-term lease. However, a longer refurbishment period means the lease is unlikely to be a short-term lease.

Example - Undocumented subsidiary-parent leases

A Subsidiary uses an office building that its Parent owns. Subsidiary and Parent have no documented lease agreement. However, Subsidiary pays Parent $5,000 monthly to use the office space. Subsidiary has used the office space for a few years and has an established head office at that location.

As noted above, the lack of a written contract does not necessarily mean there is no lease contract between Parent and Subsidiary. The fact pattern indicates a month-to-month lease with either party being able to terminate with one month’s notice.

Under IFRS 16, paragraph B34, the lease is likely to be enforceable for a long period because the location of the Subsidiary’s head office is strategically important, and the Subsidiary would incur a penalty that is more than insignificant if it were to vacate the premises. Subsidiary is, therefore, unlikely to have a short-term lease in this case.

Need assistance?

Our website contains information about how BDO can help you with your lease accounting. We have a cloud-based lease management system called ‘BDO Lead’ to help you manage the complexities around implementing IFRS 16 in practice. We also provide outsourced leased management services where we manage lease accounting on your behalf using BDO Lead.

Please contact BDO’s IFRS Advisory team if you require assistance with your lease accounting.

For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared at BDO Australia. Read the original article here.