Proposed changes to accounting for contracts to acquire electricity from renewable sources

Proposed changes to accounting for contracts to acquire electricity from renewable sources

Background

In May 2024, the International Accounting Standards Board (IASB) issued exposure draft (ED) Contracts for Renewable Electricity. The ED proposes to amend IFRS 9 Financial Instruments and IFRS 7 Financial Instruments: Disclosures to address concerns raised by stakeholders about applying the current requirements to specific types of power purchase agreements (PPAs).PPAs are becoming increasingly common in businesses with high and constant electricity needs. PPAs are an alternative to standard electricity retail contracts that provide the purchaser long-term pricing transparency. Some PPAs can also assist businesses in meeting their sustainability goals by reducing their Scope 2 greenhouse gas (GHG) emissions and generating renewable energy certificates (RECs).

| In June 2023, the IFRS Interpretations Committee (Committee) discussed a request from a stakeholder regarding the appropriate accounting for long-term PPAs that involve the physical delivery of electricity from renewable resources (such as wind or solar) to the customer, but may also necessitate the customer selling any unused electricity back into the grid at the applicable spot rate. The request noted that because the electricity is generated from renewable sources, the volume and timing of the electricity generation often don’t match the customer’s actual electricity needs. Consequently, in the absence of feasible options to store the electricity, and due, in part, to the design and operation of current markets for renewable electricity, the stakeholder requested guidance on how paragraph 2.4 of IFRS 9 would apply to such contracts when the customer is seemingly settling the contract net in cash but is only doing so due to factors beyond their control. That is, the customer’s primary concern is to take delivery of the electricity, and not necessarily to generate short-term gains from buying electricity at pre-determined prices and opportunistically selling it back into the grid at higher spot prices. |

Paragraph 2.4 of IFRS 9 deals with those contracts for the purchase or sale of a non-financial item (such as wheat, corn, cattle, electricity, etc) in the future by distinguishing between those that:

- Can be settled net in cash or another financial instrument, or by exchanging financial instruments as if the contracts were financial instruments (‘net in cash’), and

- Were entered into and continue to be held for the purpose of the receipt or delivery of the relevant non-financial item in accordance with the entity’s expected purchase, sale or usage requirements (‘own use’).

In response to the Committee’s deliberations at its June 2023 meeting, the IASB undertook a narrow-scope standard-setting project to address stakeholder concerns about how paragraph 2.4 of IFRS 9 should apply to contracts for renewable electricity, the results of which are contained in the ED.

As part of its deliberations, the IASB also considered the accounting implications of IFRS 9 for ‘virtual PPAs’ - PPAs that require net settlement of the difference between the prevailing market price and the contractually agreed price for the volume of electricity produced from a referenced production facility. As the objective of both ‘physical PPAs’ and ‘virtual PPAs’ is to ensure long-term access to renewable electricity and to fix the price per unit, the IASB was concerned that only focusing on physical PPAs could lead to different accounting outcomes for arrangements that are economically comparable.

What types of PPAs will the proposed amendments apply to?

The ED proposes that the amendments to IFRS 9 and IFRS 7 will only apply to contracts for renewable electricity with both of the following characteristics:- The source of production of the renewable electricity is nature-dependent, so supply cannot be guaranteed at specified times or for specified volumes. Examples of such sources of production include wind, sun and water, and

- The contract exposes the purchaser to substantially all the volume risk under the contract through ‘pay-as-produced’ features. Volume risk is the risk that the volume of electricity produced does not align with the purchaser’s demand for electricity at the time of production.

In the absence of an IFRS® Accounting Standard that specifically applies to a transaction or other event, IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors facilitates entities developing and applying an accounting policy from, for instance, requirements in an IFRS Accounting Standard (or Standards) ‘by analogy’. However, the ED proposes that such analogising will not extend to any changes resulting from the ED, principally because the IASB wanted to develop a timely solution for PPAs and therefore, had not deliberated on any unintended consequences of applying the proposals to contracts other than renewable electricity contracts with the characteristics above.

How will the proposed amendments impact the application of the own use exemption to renewable electricity PPA contracts?

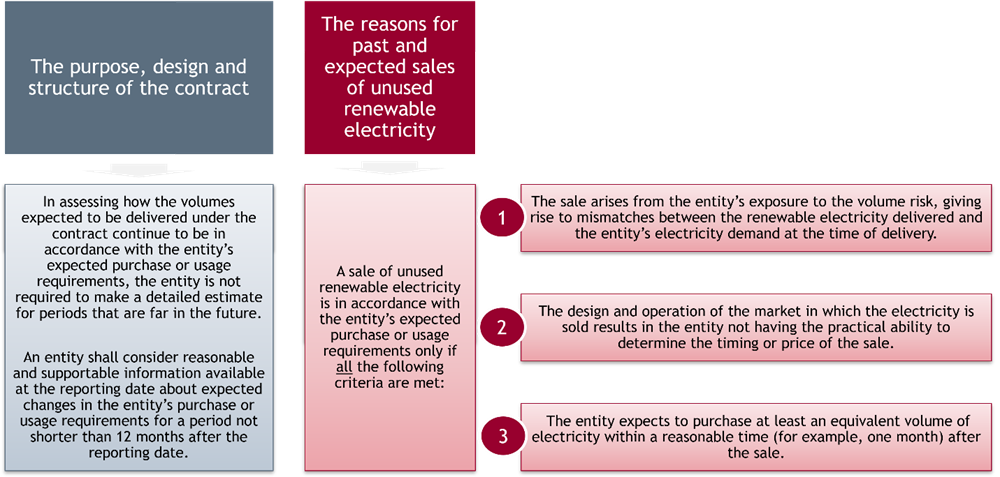

The ED proposes including application guidance in IFRS 9 to clarify that in applying the own use exemption to renewable electricity contracts within the scope of the ED, an entity would consider at the inception of the contract and each subsequent reporting date the following:

The Basis for Conclusions to the ED makes it clear that the IASB’s intention is not to permit any and all contracts for renewable electricity to be accounted for ‘off balance sheet’. If an entity enters into a contract that is expected to continuously deliver more electricity than the entity needs, such an ‘oversized’ contract would not be in accordance with the entity’s expected usage requirements (ED IFRS 9.BC20(a)), and the own use exemption is not met. However, if the criteria for applying the own use exemption are met, it must be applied mandatorily.

| The own use exemption cannot be applied to virtual PPAs because they involve net settlement in cash with no physical delivery of electricity. |

How will the proposed amendments impact the application of hedge accounting to renewable electricity PPA contracts?

For those renewable electricity contracts (physical or virtual) that have the characteristics described above, the ED permits an entity to designate a variable nominal volume of forecasted electricity transactions (sales or purchases) as a hedged item in a cash flow hedging relationship if both of the following criteria are met:- The hedged item is specified as the variable volume of electricity to which the hedging instrument relates, and

- The variable volume of forecast electricity transactions designated above does not exceed the volume of future electricity transactions that are highly probable.

Without the proposed amendments in the ED, entities would face challenges in applying the hedge accounting requirements in IFRS 9 to PPAs. IFRS 9 currently requires the hedged item to be designated as a specified nominal amount or volume, or a component of such a nominal amount or volume. As noted above, entities typically enter into long-term PPAs to minimise the cash flow implications of changes in the spot price of electricity. However, due to the nature-dependency of renewable electricity PPAs, and the requirement to define at the inception of a hedging arrangement an absolute volume of electricity that cannot be changed throughout the duration of the arrangement, entities designating renewable energy PPAs as hedging instruments are faced with the choice of:

|

Consequently, the ED proposes that for a qualifying cash flow hedging arrangement, an entity could designate the hedged item as the variable volume of renewable electricity to which the hedging instrument relates. Accordingly, the entity would be required to measure the hedged item using the same volume assumptions as those used for measuring the hedging instrument. However, all other assumptions and inputs used for measuring the hedged item, including pricing assumptions, would be required to reflect the nature and characteristics of the hedged item and would not impute the features of the hedging instrument.

How will the proposed amendments impact disclosures applicable to renewable electricity PPA contracts?

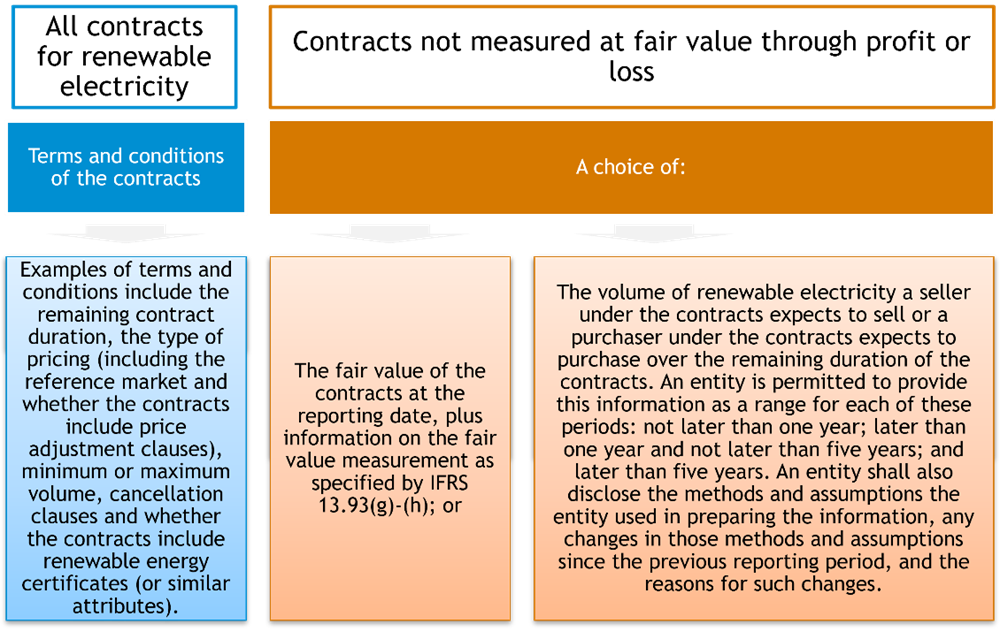

Currently, PPAs that meet the own use exemption in IFRS 9 and are accounted for as executory contracts are not subject to disclosures under IFRS 7.During its deliberations on the proposals in the ED, the IASB noted that stakeholders want greater transparency about renewable electricity contracts, including those that meet the own use exemption under IFRS 9. Consequently, entities that are a party to a renewable electricity PPA (physical or virtual) that falls within the scope of the ED would be required to make additional disclosures as follows:

Next steps

The ED’s comment period closes on 7 August 2024. The IASB is expected to move quickly to issue final amendments before the end of 2024. The ED suggests an effective date of annual reporting periods beginning on or after 1 January 2025, although the IASB has asked stakeholders whether they consider this date would allow sufficient time for preparers. We expect early application to be permitted.We are here to help

Accounting for PPAs is complicated, particularly given the lack of guidance to date. Please contact our Financial Reporting Advisory team if you need help.For more on the above, please contact your local BDO representative.

This article has been based on an article that originally appeared on BDO Australia, read the original article here.