How to account for reverse factoring/supply chain financing arrangements

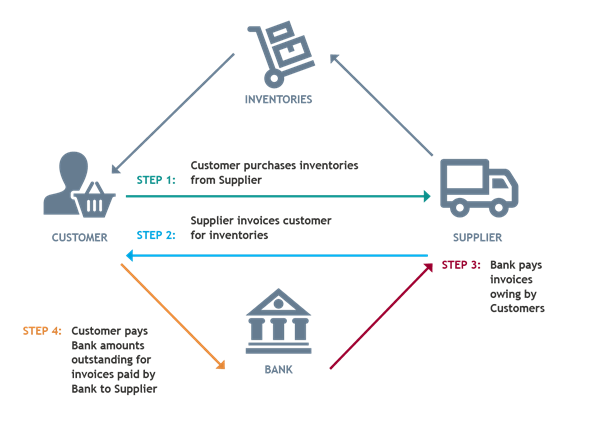

Reverse factoring/supply chain arrangements are becoming increasing popular as a means to facilitate faster payment by customers of their supplier invoices. These arrangements involve three parties: the customer, the supplier, and a bank/financier. The supplier wants to be paid within a quicker time frame than the customer is willing or able to meet, so the supplier effectively ‘discounts’ the customer invoice with the bank/financier, without recourse back to the supplier. This means that the customer’s liability to the supplier is discharged, and the customer now owes the invoice amount to the bank.

These arrangements take many forms so terms and conditions may vary from one arrangement to another. For example, if the customer has a long period to repay the bank/financier, the debt may attract interest, and depending on the customer’s credit risk, they may need to provide security to the bank/financier because the bank/financier no longer has recourse to the supplier.

Accounting for reverse factoring arrangements was discussed recently by the IFRS Interpretations Committee (Committee). The Committee issued a final agenda decision in December 2020, outlining how IFRS standards already provide guidance on the appropriate accounting classification and disclosures for reverse factoring arrangements. This article summarises factors outlined in the agenda decision that preparers should consider when presenting these types of arrangements in their financial statements. You can also view some brief eLearning materials on this agenda decision.Should reverse factoring arrangements be presented as trade payables or borrowings in the balance sheet?

‘Trade and other payables’ must be presented separately in the balance sheet from ‘other financial liabilities’ because they are sufficiently different in nature or function to warrant separate presentation. IAS 1 Presentation of Financial Statements, paragraph 55 also requires entities to present additional line items in the balance sheet when such presentation is relevant to a user’s understanding of the entity’s financial position.

Depending on the facts and circumstances of each reverse factoring arrangement, entities need to decide whether they have a ‘trade and other payable’, an ‘other financial liability’ or a separate reverse factoring liability on their balance sheet.

What are trade payables?

“…trade payables are liabilities to pay for goods or services that have been received or supplied and have been invoiced or formally agreed with the supplier…” IAS 37, paragraph 11(a)IAS 1, paragraph 70 also notes that some current liabilities, such as trade payables and some accruals for employee and other operating costs, are part of the working capital used in the entity’s normal operating cycle.

A customer’s outstanding reverse factoring liability to the bank/financier can therefore only be presented as a ‘trade payable’ if it:

- Represents a liability to pay for goods and services

- Is invoiced and formally agreed with the supplier, and

- Is part of the working capital used in its normal operating cycle.

In other words, the reverse factoring liability should only be classified as part of ‘trade and other payables’ if the liability has a similar nature and function to trade payables, e.g., if:

- It is part of the working capital used in the entity’s normal operating cycle

- The terms are similar to those of other trade payables (no interest or similar interest rates), and

- Similar to other trade payables, the debt is unsecured.

Classification as other financial liabilities (borrowings)

If the reverse factoring liability is not considered a trade and other payable because it is not similar in nature and function, it is presented in the balance sheet as an ‘other’ financial liability (borrowings). The following factors could indicate that the liability is a borrowing rather than a trade payable.

- If the repayment period of the reverse factoring liability is significantly longer than the normal working capital cycle.

- If interest is charged by the bank/financier, although this may not always be the case if the supplier would have imposed a similar interest charge for extended payment terms.

- If security is provided to the bank/financier (trade payables are usually unsecured).

Note, however, that the above list is non-exhaustive and other facts and circumstances may be relevant to whether a reverse factoring arrangement gives rise to a financial liability rather than a trade payable.

Disaggregation

Once the customer has determined whether the reverse factoring liability is to be classified as ‘trade and other payables’ or as borrowings, they need to determine whether further disaggregation is required. If reverse factoring liabilities comprise a material portion of these line items, the customer may determine that the reverse factoring portion be shown as a separate line item in the balance, or otherwise in the notes.

Derecognition of a financial liability

The agenda decision notes that a financial liability is only derecognised and removed from the statement of financial position when it is extinguished, i.e. it is discharged, cancelled, or expires (refer IFRS 9 Financial Instruments, paragraph 3.3.1).

It is worth pointing out that derecognition does not automatically mean that the original trade payable becomes a borrowing. The agenda decision requires that the ‘new liability’ be presented in the balance sheet in accordance with the presentation requirements in IAS 1 (as discussed above).If the liability to the supplier is extinguished when the bank/financier pays the supplier, some may argue that the reverse factoring liability owing to the bank/financier should be classified as a borrowing because it no longer represents a liability to pay for goods and services. However, the agenda decision specifically requires classification as a trade payable or borrowing according to the principles outlined above. Accordingly, the identity of the entity to which the consideration is ultimately paid is not determinative for the classification of the liability.

How should these arrangements be presented in the cash flow statement?

Cash flows involved in these arrangements are classified either as being from operating activities or as financing activities, i.e.:

- Operating activities, i.e., cash flows from the principal revenue-producing activities of the entity that are not investing or financing activities; or

- Financing activities – cash flows as a result of changes in the size and composition of the contributed equity and borrowings of the entity.

The table below illustrates the cash flow impacts for both these scenarios, and highlights some peculiarities, namely:

- When the debt is classified as trade payables, if the arrangement is settled ‘gross’ with cash flowing in and out of the customer’s bank account, cash outflows from operating activities appear twice for the same purchase, and

- When the debt is classified as borrowings and the arrangement is settled ‘net’ (i.e., no cash inflow and outflow through the customer’s bank account), no cash outflow from operating activities is ever presented for payments of the supplier invoices.

| Liability presented as... | Bank/financier pays supplier directly | Bank/financier pays customer who settles supplier debt Likely to occur infrequently |

|

| Trade payable | Cash inflow from bank | N/A | Cash inflow from OPERATING ACTIVITIES |

| Cash outflow to supplier | N/A | Cash outflowfrom OPERATING ACTIVITIES | |

| Final settlement of reverse factoring liability to bank/financier | Cash outflow from OPERATING ACTIVITIES | Cash outflow from OPERATING ACTIVITIES | |

| Borrowings | Cash inflow from bank/financier | N/A | Cash inflow from FINANCING ACTIVITIES |

| Cash outflow to supplier | N/A | Cash outflow from OPERATING ACTIVITIES | |

| Final settlement of reverse factoring liability to bank/financier | Cash outflow from FINANCING ACTIVITIES | Cash outflow from FINANCING ACTIVITIES |

Non-cash financing transactions

It is important to note that the statement of cash flows only includes transactions for which there has been an inflow to, or outflow from, the customer’s bank account. If the customer presents the liability owing to the bank/financier as trade payables, no further disclosure is required. However, if it presents the liability as borrowings, there has been a non-cash increase in borrowings (non-cash increase in financing activities) that must be disclosed as required by IAS 7, paragraph 43.

Investing and financing transactions that do not require the use of cash or cash equivalents shall be excluded from a statement of cash flows. Such transactions shall be disclosed elsewhere in the financial statements in a way that provides all the relevant information about these investing and financing activities. IAS 7, paragraph 43Are any additional disclosures required?

Yes. The agenda decision notes that the current disclosures in IFRS standards would require disclosure about reverse factoring arrangements as follows:

- Liquidity risk

- Changes in liabilities arising from financing activities

- Additional information (if required).

(Certain RDR exemptions from these disclosures are available to Tier 2 NZ IFRD RDR reporters.)

Liquidity risk

IFRS 7, paragraphs 33-35 require quantitative and qualitative disclosures about liquidity risk, and paragraph 39 requires disclosure of the maturity analysis. Reverse factoring arrangements give rise to liquidity risk because:

- The entity has concentrated a portion of its financing with one financial institution rather than a diverse group of suppliers. The entity may also have other borrowings with the same financial institution subject to the reverse factoring arrangement. If the entity encounters difficulty making repayments, the concentration increases the risk that the entity may have to pay a significant amount at one time, to one counterparty.

- The entity may have become reliant on extended payment terms, or the entity’s suppliers may have become reliant on earlier payment terms. If the financial institution was unwilling or unable to continue to honour the reverse factoring arrangement, this could affect the entity’s ability to settle liabilities when they are due.

Changes in liabilities arising from financing activities

If the customer classifies the reverse factoring liability as a borrowing, and presents cash flows relating to this as being from ‘financing activities’, IAS 7, paragraph 44A requires disclosure to enable users to evaluate changes in liabilities arising from financing activities (both cash flow changes and non-cash flow changes). This is usually presented in the form of a reconciliation, including the lines items listed in IAS 7, paragraph 44B.

Additional information (if required)

Additional information may also need to be disclosed about:

- Significant judgements made by the customer regarding its presentation of the liability as a trade payable or borrowing (IAS 1, paragraph 122)

- The reverse factoring arrangement that is material to the financial statements. IAS 1, paragraph 112(c) requires disclosure of information that is relevant to an understanding of the financial statements if it is not disclosed elsewhere in the financial statements.

Need help?

If you require assistance determining the appropriate accounting and classification of reverse factoring arrangements, please contact BDO’s IFRS Advisory Team.

For more on the above, please contact your local BDO representative.

This publication has been carefully prepared, but is general commentary only. This publication is not legal or financial advice and should not be relied upon as such. The information in this publication is subject to change at any time and therefore we give no assurance or warranty that the information is current when read. The publication cannot be relied upon to cover any specific situation and you should not act, or refrain from acting, upon the information contained therein without obtaining specific professional advice. Please contact the BDO member firms in New Zealand to discuss these matters in the context of your particular circumstances.

BDO New Zealand and each BDO member firm in New Zealand, their partners and/or directors, employees and agents do not give any warranty as to the accuracy, reliability or completeness of information contained in this article nor do they accept or assume any liability or duty of care for any loss arising from any action taken or not taken by anyone in reliance on the information in this publication or for any decision based on it, except in so far as any liability under statute cannot be excluded. Read full Disclaimer.