Transitioning to IFRS 16 - Your options and what to do with residual balances

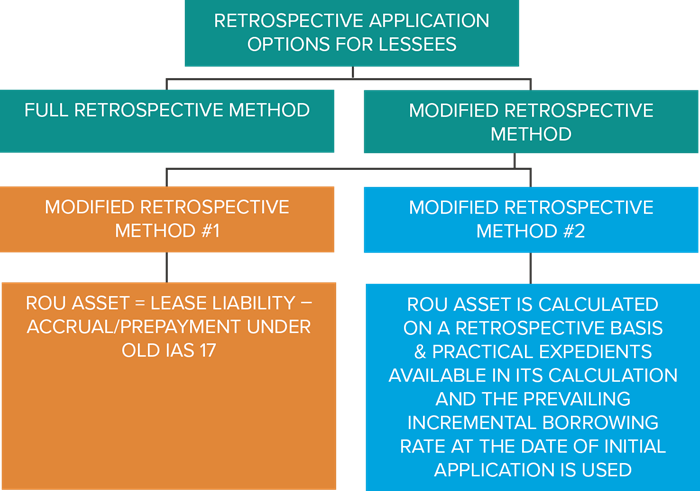

When transitioning to IFRS 16 Leases, lessees have three choices when determining the amounts of right-of-use (ROU) assets and lease liabilities to capitalise on the balance sheet. These are illustrated in the diagram below.

We anticipate that most lessees with 31 March 2020 and 30 June 2020 reporting dates will apply either modified retrospective method #1 or #2 when first applying IFRS 16 on, respectively, 1 April 2019 or 1 July 2019 (transition date), so this article focusses only on these two approaches.

The benefits of using either of these two approaches are that lessees use the incremental borrowing rate (IBR) at 1 April 2019 for 31 March year ends (or 1 July 2019 for 30 June year ends) to determine the net present value of all future lease payments, and the ability to use various practical expedients.

Both these methods work exactly the same to determine the lease liability at 1 April 2019 (or 1 July 2019). The difference relates to determining the ROU asset at 1 April 2019 (or 1 July 2019) with:

- Modified retrospective method #1 allowing for the ROU asset simply to equal the amount of the lease liability on 1 April 2019 (or 1 July 2019) (which is determined using the IBR on 1 April 2019 (or 1 July 2019), but adjusted for any lease accruals or prepayments at that date, and

- Modified retrospective method #2 allowing for the ROU asset to be determined as if IFRS 16 had been applied since the commencement of the lease, but using the IBR on 1 April 2019 (or 1 July 2019), rather than at the start of the lease.

Modified retrospective method #1 is simpler to apply in practice but often results in a higher ROU asset balance on transition, which leads to higher amortisation charges in future, and also greater pressure for impairment, especially due to COVID-19. There is no adjustment to the opening balance of retained earnings on 1 April 2019 (or 1 July 2019) when using this method because the ROU asset balance equals the lease liability on 1 April 2019 (or 1 July 2019).

Modified retrospective method #2 involves more detailed calculations to determine the ROU asset balance on 1 April 2019 (or 1 July 2019) because amortisation needs to be determined from the commencement of the lease through to transition date (1 April 2019 (or 1 July 2019)). If using this method, there will be adjustments recognised in opening balances of retained earnings on 1 April 2019 (or 1 July 2019) because the ROU asset and lease liability will not be equal. This method leads to lower amortisation charges in future, and also less pressure for impairment, especially due to COVID-19.

Residual balances from IAS 17 accounting

While the modified transition methods described above dictate the determination of ROU assets and lease liabilities under IFRS 16, they are not always prescriptive about what to do with residual balances in the balance sheet remaining at transition date (1 April 2019 (or 1 July 2019)) such as:

- Prepaid or accrued lease payments

- Rent free period liabilities

- Straight-line lease liabilities for fixed rate rent increments, and

- Leasehold improvements related to restoration obligation.

Modified retrospective method #1 – Adjust ROU asset

This transition method specifically requires that prepaid or accrued lease payments are adjusted against the ROU asset on transition date (IFRS 16, paragraph C8(b)(ii)). This will result in the ROU asset not actually being the same as the lease liability on 1 April 2019 (or 1 July 2019).

Rent-free period liabilities and liabilities for fixed rate rental increments both result in IAS 17 straight-line lease liabilities remaining on the balance sheet on 31 March 2019 (or30 June 2019). Both these balances will also need to be derecognised by adjusting the carrying amount of the ROU asset on transition. While IFRS 16 is not prescriptive in this regard, economically both these balances represent accrued lease payments.

Lastly, many lessees would have correctly recognised the ‘asset side’ of make good restoration obligations as leasehold improvements. IFRS 16, paragraph 24(d) requires the cost of dismantling and removing the ROU asset to be included as part of the cost of the ROU asset, therefore post transition, technically these should be derecognised and transferred to the ROU asset. However, practically there is unlikely to be a material difference is these leasehold improvements are kept as a separate asset.

Modified retrospective method #2 – Adjust opening balance of retained earnings

If the entity is using the modified retrospective method #2 to calculate the ROU on transition, IFRS 16 is silent on what to do with remaining IAS 17 balances. However, given that the ROU asset is determined as if IFRS 16 had been applied since the commencement of the lease, there is no scope for adjusting these residual balances against the ROU asset on 1 April 2019 (or 1 July 2019) because the ROU asset is correctly calculated in accordance with IFRS 16, paragraph 24.

The cost of the right-of-use asset shall comprise: (a) the amount of the initial measurement of the lease liability, as described in paragraph 26; (b) any lease payments made at or before the commencement date, less any lease incentives received; (c) any initial direct costs incurred by the lessee; and (d) an estimate of costs to be incurred by the lessee in dismantling and removing the underlying asset, restoring the site on which it is located or restoring the underlying asset to the condition required by the terms and conditions of the lease, unless those costs are incurred to produce inventories. The lessee incurs the obligation for those costs either at the commencement date or as a consequence of having used the underlying asset during a particular period. IFRS 16, paragraph 24Therefore, the balance of prepaid or accrued lease payments, and rent free and fixed increment straight-line lease liabilities are all removed from the balance sheet by adjusting the opening balance of retained earnings on 1 April 2019 (or 1 July 2019).

The ‘asset side’ of make good restoration obligations recognised as leasehold improvements will also need to be derecognised on 1 April 2019 (or 1 July 2019), and again, this is done by adjusting the opening balance of retained earnings on 1 April 2019 (or 1 July 2019). While this asset was retained under modified retrospective method #1 (by leaving as leasehold improvements or transferring to the balance of the ROU asset), under modified retrospective method #2, paragraph 24(d) would have resulted in the ROU asset at the commencement of the lease including the requisite ‘asset side’ of the restoration obligations. Therefore, to retain this asset on the balance sheet at 1 April 2019 (or 1 July 2019) would be double counting the ‘asset side’ of the restoration obligation. Note that there is no change to the balance on the liability for restoration obligations, which continues to be measured under IAS 37.

Need assistance with IFRS 16 transition and ongoing reassessments and modifications

IFRS 16 is a complex standard to implement and BDO has the expertise and tools to assist you in this process. Please contact our IFRS Advisory Team who can assist with IFRS 16 transition