Justin Martin

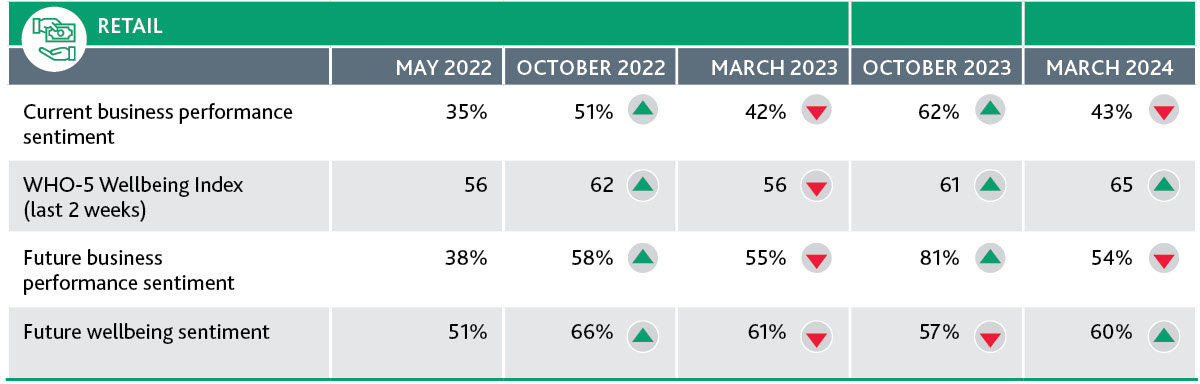

The retail sector has rebounded from its high business performance scores seen in the period immediately following the 2023 General Election, with our March 2024 survey showing leaders now have a similar outlook to what they did in March 2023. However, wellbeing scores have improved now and looking to the future, suggesting that while operating conditions might be tough, retail leaders are taking the right steps to protect their mental health.

View journalist Paddy Gower's conversation with Justin Martin, BDO Not-for-Profit Sector Leader, plus insights from Oderings Garden Centres CEO Angela Thompson.

Retail business leaders are feeling considerably less positive about their current business performance than they were in October 2023. Our March 2024 survey shows just 43% of retail leaders are feeling positive about their overall business performance all or most of the time in the past two weeks, compared to 62% in October last year. This is reflected in future business performance sentiment, where 54% of leaders say they expect to feel positive in six months’ time – a sharp decline from 81% in October 2023.

While these results show a drop in business performance sentiment from October, the latest results are in line with previous survey waves. This suggests that retail leaders were perhaps temporarily buoyed in the weeks following the election – with the new Government focusing on pro-business initiatives – but have continued to be impacted by New Zealand’s tough economic conditions.

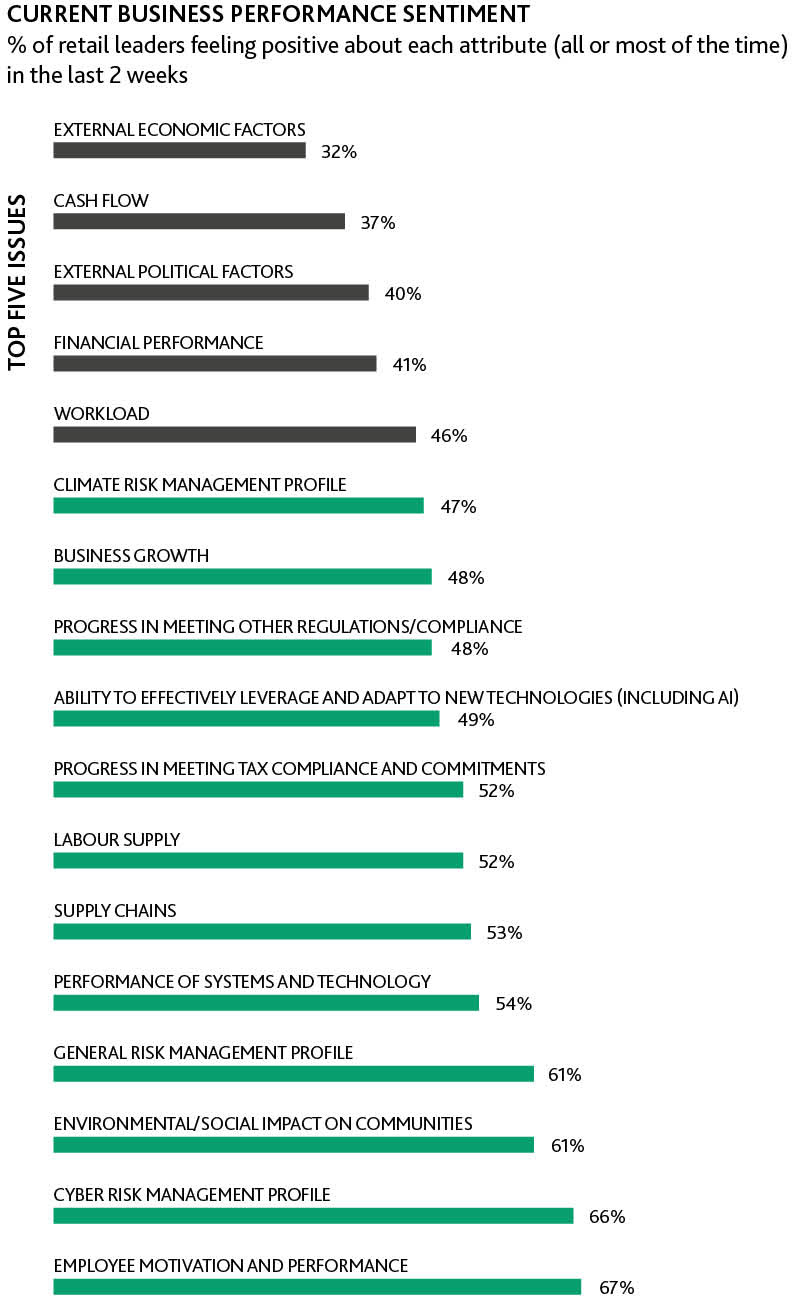

Indeed, the business performance attributes retail leaders are currently feeling least positive about are economic impacts, cash flow, and political factors. Cost of living increases are dampening consumer demand, which has a significant impact on retailers. And with retail sales volumes falling for the eighth consecutive quarter in the December 2023 quarter, it is unsurprising that retail leaders have a less than positive business performance outlook.

Although retail business performance is clearly struggling under tough market conditions, wellbeing has improved slightly since our October 2023 survey. Retail business leaders have scored 65 out of 100 on the WHO-5 Index - the World Health Organisation’s internationally recognised wellbeing measure. This is an increase from 61 in October 2023 and is the highest WHO-5 score for retailers since our first survey in May 2022.

Future wellbeing sentiment has also improved from October 2023, with 60% of retail business leaders expecting to feel satisfied with life all or most of the time in six months’ time - a 3% improvement from our last survey.

While these wellbeing measures are encouraging, business finances are a major driver of negative wellbeing for retailers both now and into the future, with 64% of retail leaders saying they expect business financial concerns to drive negative wellbeing in their lives in six months’ time. As New Zealand’s high cost of living continues to bite and consumers further tighten their purse strings, retail leaders may need to revisit their business plans to help navigate the months ahead.

Justin Martin

Divya Pahwa