Alan Scott

The Government said that Budget 2023 would be a cost of living Budget, while also being a ‘no frills’ budget without any major tax surprises. The inherent challenge here being – how could the Government reduce spending (limit inflationary pressures), while supporting Kiwis with economic security through an uncertain time and managing pressures such as health, housing and climate change?

Budget 2023 announces a change to the tax rate applying to income retained by trustees of a trust. From April 2024, the trustee tax rate will now be aligned with the top personal tax rate of 39% (currently it’s 33%) – Read more here.

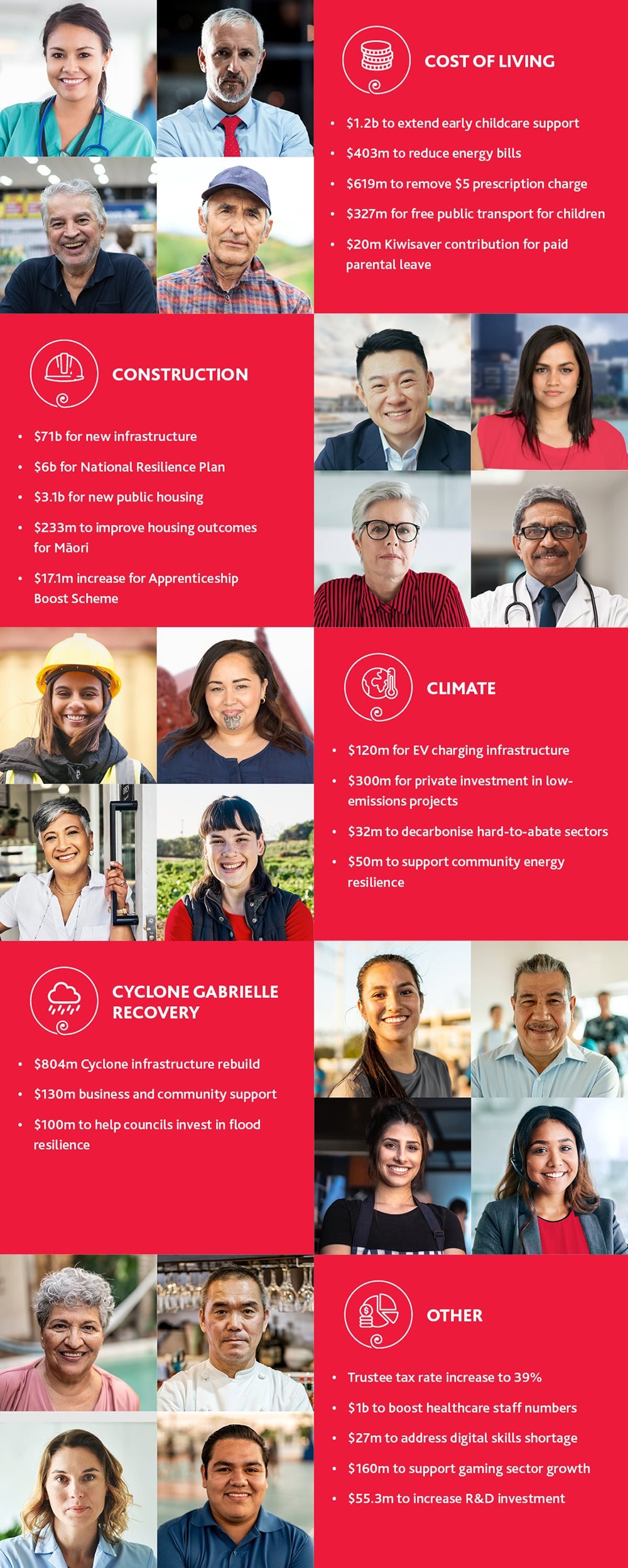

Read our extensive Budget commentary and view our handy infographic below showing all the key expenditure items business leaders need to know about.

Fresh from attending the Budget 2023 media briefing at the Beehive with Hon Grant Robertson, BDO Tax Partner Alan Scott takes us through the key expenditure announcements and policy changes, including what the Government is doing to address the cost of living crisis, and what the key impacts are for businesses.

Alan Scott

Angela Edwards

Charles Rau

Glenn Fan-Robertson

Kimberley Symon

Nick Innes-Jones

Phillip Roth

Rachel Shoebridge