Alan Scott

Finance Minister Hon Nicola Willis has delivered Budget 2024.

Prior to the Budget announcement, Nicola Willis declared the Government’s intention to lay the foundation for a stronger, more productive economy; promising Kiwis a helping hand - with a tax relief package to increase the take-home income for most New Zealanders - while cutting Government spending to take the pressure off inflation.

With economic concerns and financial pressures being the leading challenges for New Zealand business leaders right now, as highlighted in the April 2024 BDO Business Wellbeing Index, has Budget 2024 delivered on these promises?

With an operating allowance of $3.2bn per annum - the lowest operating allowance in real terms since Budget 2017 - this year’s Budget is not a big-spending instant fix , but does include a range of new measures. Click on each section to read our extensive Budget 2024 commentary on the key policies and announcements for business leade

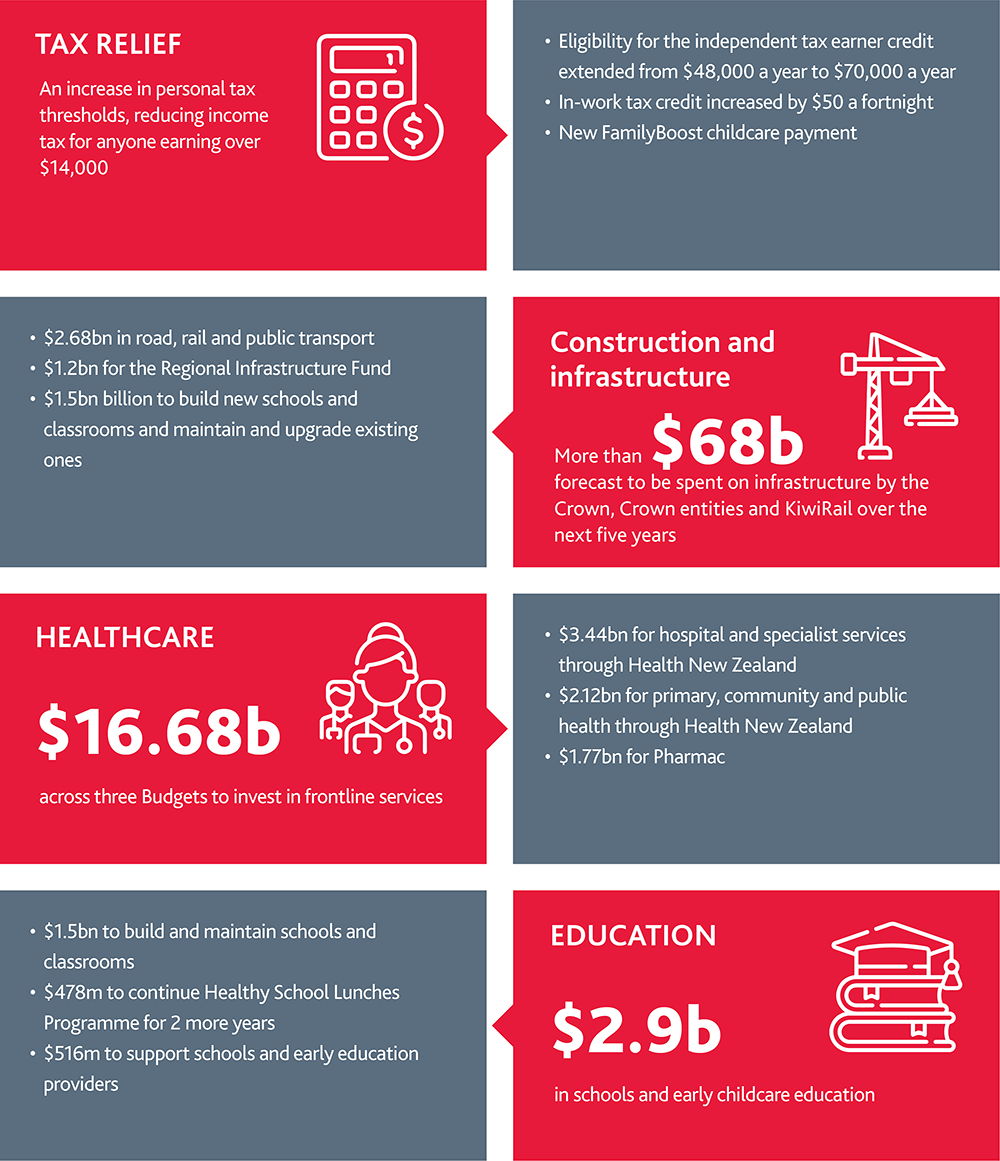

Budget 2024 has confirmed that personal tax thresholds will rise from 31 July 2024, reducing income tax for anyone earning over $14,000. This is part of a wider tax relief package aimed at easing the cost of living crisis and helping working people to keep more of the money they earn. The Government has also delivered on its promise to invest more in health, education and law and order, alongside infrastructure investment with a focus on regional resilience.

A summary of key expenditure areas and policy announcements is outlined in the graphic below.

Alan Scott, Tax Partner, highlights the key policy announcements in the Budget in the video below.

Alan Scott

Nick Innes-Jones

Divya Pahwa

Tarunesh Singh

Angela Edwards

Charles Rau

Matt Coulter

Tristan Will

Kimberley Symon