Tier 1 and Tier 2 for-profit entities need only disclose material accounting policy information in their 30 June 2024 financial statements. Changes to NZ IAS 1 Presentation of Financial Statements means that the long laundry list of accounting policies, which merely repeat recognition and measurement requirements from the accounting standards, can be removed. Our article explains what accounting policy information is material and what is not.

Keeping immaterial accounting policies is a big time-waster both for preparers and auditors. Culling unnecessary accounting policies in June 2024 financial reports is a good investment - a little time spent now will deliver time savings in the future.

These changes for Tier 1 and Tier 2 for-profit entities apply to annual periods beginning on or after 1 January 2024, so already apply to entities preparing 30 June 2024 half-year financial statements.

In addition, Tier 1 entities preparing 30 June 2024 annual financial statements must disclose the effect of these amendments on the classification of liabilities as required by NZ IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors, paragraph 30. This includes describing and quantifying the impact in your 30 June 2024 financial statements because comparatives will have to be restated.

Classifying your liabilities may be impacted by one or more of the changes to NZ IAS 1 Presentation of Financial Statements, namely:

- The right to defer settlement need not be unconditional and must exist at the end of the reporting period

- Classification is based on rights to defer, not intention

- Early conversion options for convertible notes that can be settled before maturity by issuing the entity’s own equity instruments will result in the underlying liability being classified as CURRENT if the conversion feature is classified as a liability/derivative liability rather than as equity.

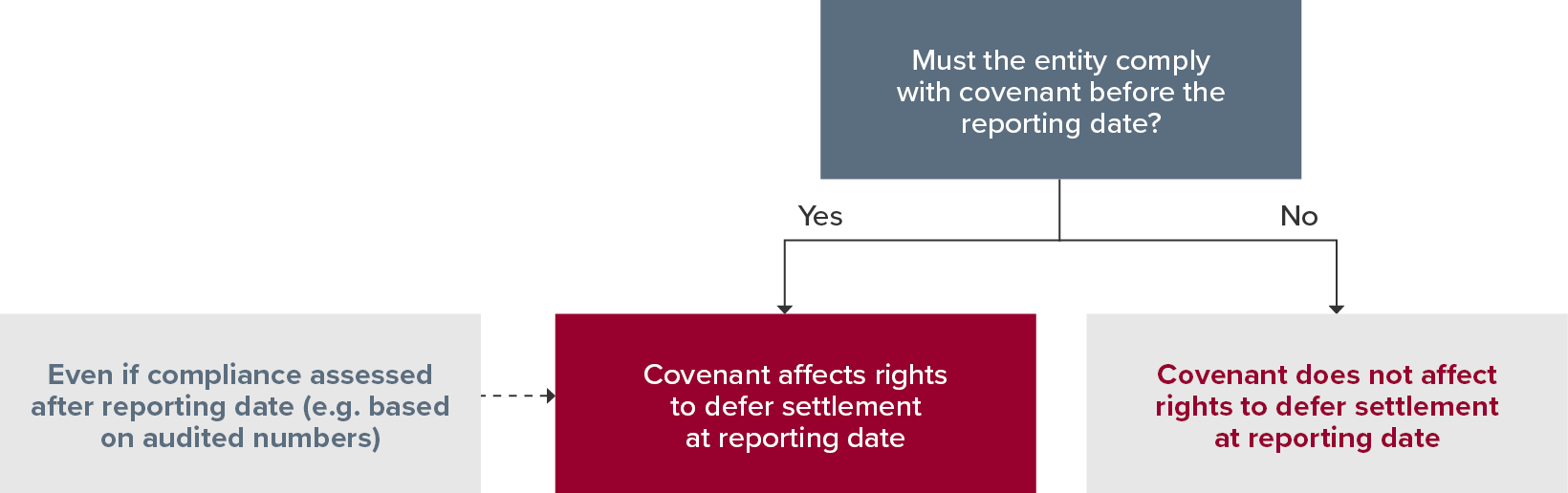

Regarding 1., if your entity has loan arrangements subject to covenants, the amendments clarify when the covenants affect classification at the reporting date. This is illustrated in the diagram below.

Assessing whether the entity must comply with a loan covenant before the reporting date may depend upon whether bankers have provided a ‘waiver’ or a ‘period of grace’. Our publication uses a flowchart and examples to help you determine the correct classification of your loan arrangements.

With the New Zealand Government committed to reducing New Zealand’s greenhouse gas emissions by 50% below 2005 levels by 2030, and achieving net zero emissions (other than biogenic methane) by 2050, preparers need to consider the implications of climate-related matters when preparing 30 June 2024 financial statements.

Educational materials published by the International Accounting Standards Board (IASB) summarise how companies must consider climate-related issues when applying IFRS® Accounting Standards. This includes when determining values for assets, liabilities, and provisions, and making disclosures regarding estimates and judgements. Please refer to our publication for a summary of these educational materials.

ESMA’s ‘Heat is On’ Report also provides real-life, practical examples to illustrate how entities can improve their climate-related disclosures for areas where climate matters are likely to have the greatest impact. Our article contains more information on this.

New Zealand entities that fall within the Climate-Related Disclosures (CRD) regime also need to ensure that disclosures in compliance with Aotearoa New Zealand Climate Standards are also complied with. Please refer to our October 2021 article and for more information on these requirements.

In addition, all Tier 1 and Tier 2 entities should consider whether they fall within other jurisdictions’ sustainability disclosure requirements, as is covered in our August 2023 article.

For annual reporting periods ending 30 June 2024, insurers, and non-insurers entering into insurance contracts must apply the new insurance standard, NZ IFRS 17 Insurance Contracts, for the first time. All Tier 1 and Tier 2 for-profit entities must ensure they comply with the new rules regarding disclosing material accounting policy information, and accounting for deferred tax related to assets and liabilities that arise in a single transaction – this mainly affects leases and restoration provisions. Lastly, country-by-country reporting entities also need to take note of mandatory exemptions for deferred tax relating to Pillar Two income taxes and additional disclosures.

Other than insurers, and non-insurers entering into insurance contracts, Public Benefit entities (PBEs) do not have any major new standards or amendments to comply with for 30 June 2024 year ends.

The table below summarises the new standards that will apply for the first time to 30 June 2024 annual periods. Please refer to the listed resources for more information or contact our Financial Reporting Advisory team for assistance.

For-profit Entities

| Standard number | Topic | Resources |

|---|---|---|

NZ IFRS 17 | Insurance Contracts | |

Amendments to NZ IAS 1 | Disclosure of accounting policies | Expect to see a reduction in the amount of accounting policy disclosures

|

Amendments to NZ IAS 8 | Definition of accounting estimates | |

Amendments to NZ IAS 12 | Deferred tax related to assets and liabilities arising from a single transaction |

|

Amendments to NZ IAS 12 | Pillar Two Model Rules | Pillar Two disclosures in 31 December 2023 interim and annual financial statements

|

Public Benefit Entities

| Standard number | Topic | Resources |

|---|---|---|

Omnibus Amendments | 2022 Omnibus Amendments to PBE Standards | |

PBE IFRS 17 | Insurance Contracts | |

Non-Authoritative Amendments to PBE IPSAS 41 | Public Sector Specific Financial Instruments |

Please ensure you have considered the impact of these standards in your 30 June 2024 annual financial statements.

The following standards apply for the first time for annual periods beginning on or after 1 January 2024, and must be adopted in 30 June 2024 half-year financial statements. Please refer to the resources listed for more information or contact our Financial Reporting Advisory team for assistance.

For-profit Entities

Standard number | Topic | BDO Resources |

Amendments to NZ IAS 1 | Classification of liabilities as current or non-current | |

Amendments to NZ IFRS 16 | Lease liability in a sale and leaseback | |

Amendments to NZ IFRS 7 and NZ IAS 7 | Supplier finance arrangements | IASB approves changes to the accounting for supplier finance arrangements How to account for reverse factoring/supply chain financing arrangements |

Amendments to FRS-44 | Disclosure of Fees for Audit Firms' Services | Disclosure of fees for audit firms’ services (amendments to FRS-44 and PBE IPSAS 1) |

Public Benefit Entities

Standard number | Topic | BDO Resources |

Amendments to PBE IPSAS 1 | Disclosure of Fees for Audit Firms' Services | Disclosure of fees for audit firms’ services (amendments to FRS-44 and PBE IPSAS 1) |

IFRS Interpretations Committee (Committee) agenda decisions are those issues the Committee decided not to take onto its agenda. Although not authoritative guidance, these decisions are regarded as being highly persuasive in practice. All entities reporting under IFRS® Accounting Standards should be aware of these decisions, as they could impact how particular transactions and balances are accounted for. While agenda decisions have no start date, they are expected to be applied as soon as possible, usually by the next reporting date. Agenda decisions merely clarify existing accounting principles. Therefore, any adjustments required are generally treated as a voluntary change in accounting policy (with retrospective restatement), rather than an error.

If there is an overlap in accounting requirements between IFRS / NZ IFRS and PBE Standards, these decisions would also impact on PBE Reporters.

Over the past twelve months, the Committee has issued the following agenda decisions:

- Climate-related commitments (April 2024)

- Payments contingent on continued employment during handover periods (April 2024)

- Merger between a parent and its subsidiary in separate financial statements (January 2024)

- Guarantee over a derivative contract – IFRS 9 Financial Instruments (October 2023)

- Homes and home loans provided to employees (October 2023)

- Premiums receivable from an intermediary (IFRS 17 Insurance Contracts and IFRS 9 Financial Instruments) (October 2023)

Please ensure your 30 June annual and half-year financial statements reflect the conclusions in these agenda decisions. You can find more information about these agenda decisions in our previous articles:

Despite a recent spike in inflation, New Zealand has experienced low inflation levels for decades, and many for-profit entities may need to be aware of special accounting requirements when an entity operates in countries whose economy and functional currency are considered hyperinflationary.

When an entity’s functional currency is ‘hyperinflationary’, NZ IAS 29 Financial reporting in hyperinflationary economies requires the financial statements (including any comparative periods) to be stated in terms of the measuring unit current at the end of the applicable reporting period. This is because the currency of a hyperinflationary economy loses a significant amount of purchasing power from period to period, such that presenting financial information based on historical amounts, even if only a few months old, does not provide relevant information to users of financial statements.

Economies which were hyperinflationary as at 31 December 2023 | Economies which become hyperinflationary in 2024 | Economies that have a risk of becoming hyperinflationary (watchlist for 2024 onwards) |

| None, however, see Egypt (note 2 below) |

|

1. Yemen will likely no longer be considered hyperinflationary on 30 June 2024. Continue to monitor based on final future inflation figures. 2. Recent monthly inflation rates remain high – likely Egypt will become hyperinflationary by 31 December 2024. | ||

Entities preparing Tier 1 general purpose financial statements must disclose the anticipated effect of new standards issued, which are not effective at the reporting date (refer to NZ IAS 8, paragraph 30 / PBE IPSAS 3, paragraph 35). These are listed in the table below. Please refer to the resources listed for more information or contact our Financial Reporting Advisory team for assistance.

For-profit Entities

Standard number | Topic | BDO Resources | Effective for annual periods commencing |

Amendments to NZ IAS 1 | Classification of liabilities as current or non-current | 1 January 2024 | |

Amendments to NZ IFRS 16 | Lease liability in a sale and leaseback | 1 January 2024 | |

Amendments to NZ IFRS 7 and NZ IAS 7 | Supplier finance arrangements | IASB approves changes to the accounting for supplier finance arrangements How to account for reverse factoring/supply chain financing arrangements | 1 January 2024 |

Amendments to FRS-44 | Disclosure of Fees for Audit Firms' Services | Disclosure of fees for audit firms’ services (amendments to FRS-44 and PBE IPSAS 1) | 1 January 2024 |

Amendments to NZ IAS 21 and IFRS 1 | Lack of exchangeability | How to determine the exchange rate when a currency is not exchangeable into another currency | 1 January 2025 |

NZ IFRS 18 | Presentation and disclosure in financial statements |

| 1 January 2027 |

Public Benefit Entities

Standard number | Topic | BDO Resources | Effective for annual periods commencing |

Amendments to FRS-44 | Disclosure of Fees for Audit Firms' Services | Disclosure of fees for audit firms’ services (amendments to FRS-44 and PBE IPSAS 1) | 1 January 2024 |